The Autumn Statement 2025

The Autumn Budget 2025

Well, the whole country has had to endure weeks of briefings about what will be contained within the Budget. The Chancellor was basically dipping her toe in the water to see how warm the British public would be to hear tax raising ideas. Or as the leader of the opposition stated, she went on breakfast TV to make a public service announcement, stop eating your Cheerios, I’m going to increase income tax by 2% and then two days later says that she will not. This has created weeks of uncertainty and fear amongst business owners, those that owns their own home or have savings.

To make matters worse, before the Budget was even delivered, the Office of Budget Responsibility ‘OBR’ had already released their report on the Budget prior to the Chancellor delivering her speech to Parliament.

How many times did you hear the Chancellor blame the previous government for the decisions she has to make? We are 18 months on from the previous government, will her constant blame of the previous government ever stop? The British public are tired of this blame culture, those who voted Labour into government gave them a remit to deliver on their manifesto, when will they get on with that and stop the blame game?

At the last Budget we were promised that the tax rises that were imposed in the country would not be repeated in years to come. The only matters worthy of reporting are the fresh round of tax increases being imposed on the working and the investing people of this country.

It is encouraging to hear that the government has managed to claw back £400m spent during the COVID pandemic on dodgy pandemic and spending contracts.

The Key Take Away Points From Today’s Budget

Income Tax and National Insurance Contribution

- Thresholds these have been frozen till 2028-29. When she implicitly stated in the last Budget that she would not.

- Basic rate and Higher rate of tax on property, savings and dividends will increase by 2%.

Here we go playing politics once again and making tax even more complicated. A simpler solution would have been to reduced National Insurance Contributions by 2% and raise the rate of income tax across the board by 2% to 22%. This government would have to admit breaking a manifesto pledge if they did that, but the average taxpayer would have a better chance of understanding tax rates.

Wages

- Minimum Wages and the National Living Wage has gone up again, what does this mean for workers:

- aged 21 and over on the National Living Wage will receive £12.71 an hour, up from £12.21

- aged 18, 19 or 20, the National Minimum Wage increase to £10.85 an hour, up from £10

- aged 16 or 17, the minimum wage will rise to £8 an hour, up from £7.55

Salary Sacrifice pension contributions

- Up till now these benefited from being free of National Insurance Contributions, this will now be limited to £2,000 annually.

- While restricting the private sector’s ability to save for their retirement. Public sector funded pension continue to balloon.

- Private sector pensions

Cash ISA

- From April 2027, the limit will be reduced from £20,000 per annum down to £12,000 per annum but this only applies to those under the age of 65.

- Those over 65 remain unaffected.

High Value Council Tax Surcharge

- There will be four bands:

- £2,500 more per year for house worth £2m – £2.5m; up to

- £7,500 more per year for a house worth more than £5m.

Inheritance Tax

- The rates if IHT thresholds has been fixed at their current levels till 2031.

- Nil Rate Band at £325,000

- Residential Nil Rate Band at £175,000

- Residential Nil Rate Band taper, starting at £2 million

- combined £1 million allowance for 100% Agricultural Property Relief and Business Property Relief

Employee Ownership Trust

- From 26 November 2025, the rate of relief for business owners selling their business to an Employee Ownership Trust ‘EOT’ has been reduced from 100% to 50%.

Enterprise Management Incentive scheme

- The following changes will apply to EMI contracts granted on or after 6 April 2026:

- company options will be increased from £3 million to £6 million

- gross assets will be increased from £30 million to £120 million

- the number of employees will be increased from 250 employees to 500 employees

Venture Capital Trusts

- The rate of income tax relief on VCT investments has been reduced from 30% to 20%.

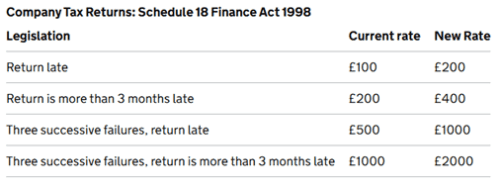

Corporation Tax Return late filing penalties

- These will double from 1 April 2026, the new rates are as follows: –

Electric Vehicles and Plug-in-Hybrid Vehicles

- From 2028, electric vehicles will be charged 3p per mile on top of other road taxes. Plug-in hybrid vehicles will be charged 1.5 per mile on top of other road taxes.

- Capital allowances – First year allowances for zero-emission cars and for electric vehicle ChargePoint’s has been extended by a further 12 months to 31 March 2027 / 5 April 2027.

- Benefit in Kind – There will be an easement of the amount on which plug-in-hybrid cars are subjected to a benefit in kind charge.

Two-child benefit cap

- The two-child benefit cap has been scrapped from 2026. This is expected to cost £2.3 billion 2026-27.

State Pension

- This is going to be increased by 4.8% per annum, far higher than the current rate of inflation, but rather apparently in line with average wage increases.

Welfare Bill

- The OBR states that the U-Turn in relation to winter fuel benefits and health-related benefits will cost £7bn in 2029-30.

- The removal of the two-child benefit cap will cost £3bn by 2029-30.

Summary

Following last year’s record tax rises on business and working people, this government is at a real risk of killing the golden goose. The continuance of hammering business and workers continues to act as a disincentive to get out of bed and work, while at the same time the welfare bill continues to balloon, all that does is to tell people it pays not to work! Most benefits are not taxable therefore their real value to an individual is significantly higher than the equivalent income from work.

The OBR tells us that the decision to freeze tax thresholds, in particular, means personal incomes are expected to grow by an average of just 0.25% per year across the rest of the decade (allowing for inflation and taxes).

While business has been over the past few years faced the cost of the COVID pandemic, an increase in Corporation Tax, an increase in Business Rates bills, an increase in Employer’s National Insurance Contributions ‘NIC’, reduction of IHT tax relief for business owners (APR and BPR) to name but a few, business owners once again suffer the state’s interference with further changes to the national minimum wage and national living wage at a time when the challenges of being an employer have increased exponentially.

It is reported that the top 1% of earners in the UK pay 30% of all income tax revenues, while it is reported on a daily basis that another wealthy businessperson has left the UK, nothing said today will do anything to turn that tide.

If you would like to discuss the changes and how they will affect you and your business, please contact us.