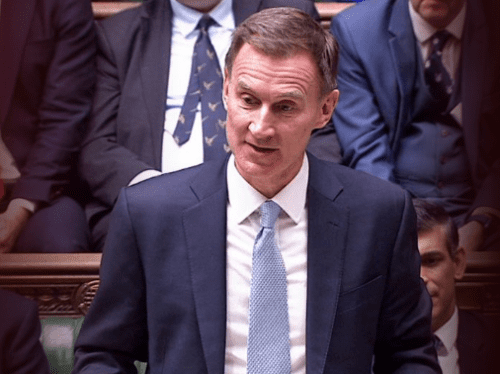

The Spring Statement 2024 – will this be his final Budget?

Spring Budget 2024

The Spring Budget 2024

Will this be his final Budget? Jeremy Hunt hopes not, he mentioned all those that had lobbied him and he bought their constituents’ votes with the changes that he announced!

Nothing new in this Budget, as is the norm these days, we read it all in the weekend papers!

What were the main highlights?

Working People

The Chancellor advised that he wanted to create an environment where it pays to go to work and that if you go to work the amount that you earn is yours and not the that of the State.

In order to incentivise those able to work but who choose not to work, to go back into the workplace and for business to therefore rely less on immigrant workers, he has announced a further 2p cut in National Insurance Contributions for employees and the self-employed.

Employees will benefit from a reduction from a rate of 10% to 8%.

Self-employed individuals will benefit from a reduction from a rate of 8% to 6%.

Furthermore, to help working parents and to obtain the vote of Martin Lewis and his followers he also announced an immediate change to the threshold at which the highest earning parent in a household is taxed on the receipt of child benefit, currently that threshold is set at £50k, this will go up to £60k from 6 April 2024. All the benefit of the child benefit being completely lost at £80k. Those affected might benefit by the tune of £1,260 per family.

From 6 April 2026, a new system will be introduced which will be based on household income. This will iron out the manner in which the system unfairly treats a single parent earning £80k per annum who receives no child benefit, whilst a two-parent family earning £40k each retains the full child benefit.

The Chancellor has finally recognised that although he had previously announced 30 hours a week of free childcare paid for by the government, childcare providers have no confidence in a UK government delivering on such financial promise. Therefore, today he has announced a guarantee on the rates that will be paid to childcare providers.

Non-domiciled Individuals

The Chancellor has today announced the abolition of the Non-Dom regime with effect from 6 April 2025. But, will it be possible to avoid the repercussions of the abolition over the course of the next 2 years during which we are in a transitional period? Tax advisors at the ready!

This Non-Dom regime will be replaced by a new residency based approach, the Chancellor announced that a new UK resident would not pay tax on their foreign income in their first 4 years of residence.

Is the devil in the detail? The Chancellor dropped into the announcement that Non-Dom’s will be able to remit foreign income over the 2 year transitional period. This clears the way for Non-Dom’s to bring foreign income (and presumably gains) into the UK without being penalised as they might have been in the past.

Property Investment

Over the past 10 years, the landlord has been public enemy number one, most probably because the UK never foresaw such large accumulation of wealth to landlords over such a short period of time. The government has experienced FOMO ‘fear of missing out’ over their period in power and have sought to disincentivise such business activities to free up housing stock that they have otherwise not managed to build.

Today the Chancellor abolished the Furnished Holiday Let ‘FHL’ regime which has provided an equal playing field to hotels, the level playing field was only available to ‘second homeowners’ that met strict requirements of letting their properties on a short-term basis, in the main providing significant additional services similar to hotels.

In addition, Multiple Dwelling Relief applicable to Stamp Duty Land Tax ‘SDLT’ have been abolished.

In the hope to release more let properties to the market, the Chancellor has reduced the rate at which Capital Gains Tax ‘CGT’ on residential properties is charged, this is reduced from 6 April 2024 from 28% down to 24%.

NHS

The Chancellor has announced that rather than just throw more money at the NHS to sort out the long waiting lists etc, he’d like to drive efficiencies within the NHS. Today he announced £3.4 billion to invest in tech and digital transformation.

We all have a very short memory! In 2013 the government abandoned an NHS patient record system at a cost of nearly £10bn, that was over 10 years ago. It appears that the government expect to achieve more for 1/3 of the money spent on an abandoned IT scheme when costs were much lower! Something does not add up Chancellor!

Business

There was very little to mention for business in general, specific support has been granted to certain industries presumably as a result of lobbying.

What can the business community be grateful for? Happier employees due to a lower NIC burden!

Businesses do not vote in themselves therefore why try to buy their votes??

Overall the Budget was exactly as most people expected. Nothing of substance apart from the further 2% reduction in Employee’s National Insurance Contributions.

If you would like to discuss the changes and how they will affect you and your business, please contact us.