The View – July 2022

Staff Focus

Welcome to the latest edition of The View, our quarterly update on the key issues both internally and externally that we think will be of interest.

In each edition we feature one of the team and in this edition it is Head of Accounts Audit and Tax, Jigna Shah

Staff Focus

Jigna Shah

Jigna was born in Kenya and moved to the UK to study Accounting & Finance at Nottingham Trent University. She subsequently qualified as a Chartered Certified Accountant and for the last 10 years has been qualified as a Chartered Tax Advisor. Having worked in an accounting practice in Central London for almost 8 years she then joined Charterhouse.

In September 2012, Jigna joined the Charterhouse team as a Tax Senior, overseeing a large portfolio of self-assessment and corporation tax clients, as well as dealing with other compliance and complex enquiry matters.

Since joining Charterhouse as a tax senior, Jigna has developed the team as well as working on complex enquiries and large restructures and was promoted to Assistant Tax Manager in June 2014.

In July 2017, she was again promoted to tax Department manager, managing a team of 9 and a portfolio of high net worth clients. Jigna has continued to develop and manage the team, at the same time factoring in the constant changes in legislation and ensuring the team is delivering well and on a timely basis on all Tax related areas.

In September 2020, Jigna was promoted to Head of Tax and a further promotion followed in April 2022 to Head of Accounts, Audit and Tax, where she now heads three departments of the firm, in addition to heading all projects, such as property planning, company restructurings and liquidations amongst various other planning opportunities that Charterhouse offers.

Outside of work, Jigna spends her time baking and enjoys Zumba classes. She enjoys travelling the world and is a great scuba diver and has swam with Blacktip sharks and Stingrays during her trip to Bora Bora and Fiji. Jigna can fluently speak 4 languages.

Business Support Unit – What it is and how it can help?

Business Support Unit – What it is and how it can help?

The Business Support Unit (BSU) was formed with the aim of allowing us to serve and support our clients in the most efficient and proactive way, and primarily deals with the following services:

Bookkeeping and Management Accounts

VAT

App advisory, training, and data migration

Accounts compliance work

A digital and real-time offering is at the heart of our service and with the ever-expanding grip of HMRC’s Making Tax Digital (MTD) transformation there has never been a better time to step into the world of digital record-keeping, even if you are not VAT registered. We primarily use and recommend a combination of Xero and Dext, and can offer training, data migration, and ongoing support on these plus a growing number of other apps which look to add value when it comes to understanding what the numbers really mean for the present and the future.

Our bookkeeping service can be as involved as required. If bookkeeping is maintained internally, we can be on hand to provide assistance with ad-hoc queries or giving an overview and feedback, or we can provide a full bookkeeping service where the role of our client is to simply ensure we have the sales and supplier information. This can include some “back-office” functions such as raising sales invoices and providing credit control facilities and preparing monthly or quarterly management accounts.

We are adaptable to the needs of our clients and aim to give proactive and useful advice and support enabling them to make informed decisions based on timely and accurate data.

We understand that each clients’ circumstances are different, and even though we offer a bespoke service to fit the needs of the business we pride ourselves on efficiency, dependability, and a can-do attitude, borne from our enjoyment of the task and a cohesive set of processes. So whether a client is a new start-up or an established business looking to grow, we can help.

All of our services throughout a year culminate in preparing year-end accounts. For companies this will include Corporation Tax return preparation and submission to HMRC to meet annual compliance requirements.

Scam Alert

HMRC Scam Alert

Almost every day we hear of another scam campaign, either sent via email or on social media, all asking for money. Be it a Nigerian Prince who has £50m to invest or someone claiming that you have gone into debt and owe them money, they are all trying to take advantage of the vulnerable.

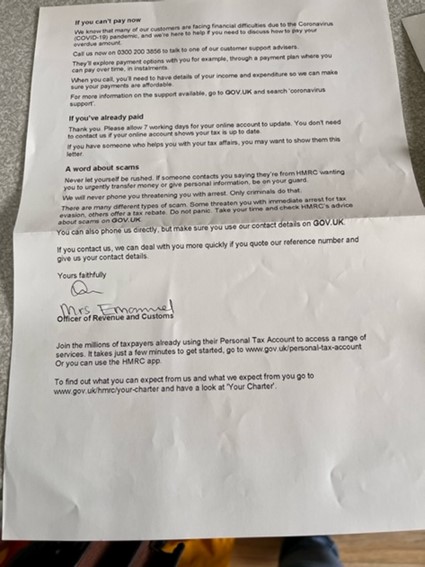

Now there is a new scam that is claiming to be from HMRC offering support in paying bills due to COVID. This campaign is via letter and gives you a phone number to call and they will help you with payment options. This number is fake and the letter is not from HMRC.

If you receive a letter from HMRC go to their website and get the contact number from there and call them direct to confirm if the letter and request is genuine or not.

A copy of the type of letter is shown in the image but if you have any queries please do not hesitate to contact us and we will be able to help.

London to Paris – The result

Owen and Charlie have completed their ride.

The peloton sped up the Champs-Elysees, heart rates were increasing, the nerves were jangling and the focus was on the finish line. This could have been the finish to the Tour de France, but in reality, it was the finish to the recent challenge that Owen and Charlie Hughes took on to raise money for Lindengate Mental Health Charity.

Following months of training in cold wet weather, not to mention hours of work raising money for the challenge, it is now done.

Unlike the Tour de France, the challenge finished under the Arc de Triomphe in spectacular surroundings, with other cyclists, all raising money for various charities close to their hearts. With a well-earned cold beer, Owen and Charlie reflected on what they had achieved.

“From the start in a quiet London at 6.30am on 8th June, through the Garden of England in Kent, the World War 1 battle fields in France and the approach and ride through Paris, the whole challenge has been incredible. It was not without the downsides, the inevitable saddle sores, very tired legs coping with the changing weather but the end result far outweighs the pain.”

To help raise the much needed funds please click here.

Charterhouse Charity Day

Charterhouse Charity Day

Over the past year we have been supporting MIND in Harrow as our Charity of the Year. The charity provides advice and support to empower anyone experiencing a mental health problem. They also campaign to improve services, raise awareness and promote understanding of mental health and the associated issues.

As part of our continued support for mental health in the workplace and community we have decided to keep supporting MIND in Harrow for the next twelve months and hope that we can help them provide more support to those who need it.

As part of our continued drive to support the local community we are planning a Team Community day in September this year. The aim of the day will be for our team to work alongside MIND in Harrow and a couple of other local community organisations to give them some extra support for a day to help deliver projects that might not otherwise have been completed. Watch this space for updates on what we achieve.

Read more here to find out more about our support of charities and community projects.

Real Living Wage Anniversary

Just over a year ago, we were all still in the depths of Covid and restrictions across every aspect of our lives. One aspect that we had already been looking at prior to the pandemic and one that became more prominent in the last two years was the support to the people who work with us and our suppliers.

Key to any job and career is the amount you earn and whilst it is not the only consideration when looking for work it is one of the most important. As an employer, our responsibility is to ensure that anyone who is working with Charterhouse Accountants earns not just the minimum wage, but a wage that ensures they can live properly. Within Charterhouse itself we pride ourselves on paying very competitive salaries, but we also wanted to ensure that anyone working for our 3rd party contractors was also treated fairly and received at least the real living wage as well.

In 2021 we decided to sign up to the “Real Living Wage” and in doing this we committed to ensure that anyone working with Charterhouse and its 3rd party contractors receives a wage which meets everyday needs – like the weekly shop, or a surprise trip to the dentist. We are now celebrating the anniversary of becoming a Real Living Wage employer.

The real Living Wage is the only UK wage rate that is voluntarily paid by almost 10,000 UK businesses who believe in the rights of their staff.

The real living wage is always under review and will help to ensure that more people in the UK are not struggling, especially in these times of high energy costs and inflation.

As a business we are always reviewing the support we give our staff and looking at new ways to ensure they are looked after both at work and at home. To find out more about the benefits of working for Charterhouse have a look at the About Us section on our website.

If you would like to know more about working for us please contact us.

The cost of living rise and the impact on mental health

For all of us, the increases in the cost of living is hitting us hard and with inflation pushing prices even higher, this trend is set to continue for the time being.

For a lot of people, having just about managed to get through the pandemic, these price increases are resulting in further pressure and having an impact on our mental health. Many people who historically have managed comfortably are now having to rely on the goodwill of others and charities to ensure they can continue to feed their families.

As a firm of accountants, we cannot influence the cost rises, we cannot reduce the cost of fuel and energy, although we wish we could. What we can do is to look at your taxes and make sure that you are not paying too much and in some cases get a tax rebate from HMRC.

Financial pressures can often be the cause of anxiety and stress in the current economic climate, so it is important to make sure your finances go as far as they can and that is where we can help.

By working with us, we can look at all your tax returns and ensure you are only paying the correct amount and in doing this, hopefully we can reduce one area of anxiety.

There are many places you can go to get support if you are struggling with anxiety or stress such as

www.nhs.uk (Mental Health Helpline)